Struggling with the complexities of small business taxes in the Philippines? Many entrepreneurs find themselves grappling with the intricate web of regulations, unsure of where to begin. Navigating the tax landscape can be overwhelming, especially when every peso counts for a small business. But fear not!

This article is your roadmap to clarity. We understand the challenges you face and aim to simplify the tax calculation process for your business. Discover straightforward methods and essential tips to accurately compute taxes, ensuring compliance without the headache. Say goodbye to confusion and hello to a streamlined approach to calculating taxes for your small business in the Philippines.

Understanding taxable income for small business in the Philippines

Definition of Taxable Income for Small Businesses in the Philippines

Taxable income for small businesses in the Philippines refers to the total income earned by the business during a specific period that is subject to taxation by the government. This includes revenue from various sources, such as sales, services rendered, and other business activities. Understanding taxable income is crucial for small business owners to fulfill their tax obligations accurately.

To calculate taxable income, one must consider the gross income generated by the business and then deduct allowable expenses. It is essential for business owners to be aware of what constitutes taxable income to comply with tax regulations in the Philippines.

Identifying Sources of Income for Small Businesses

Sales and Services:

- Primary sources of income for small businesses in the Philippines are sales of goods and services.

- Income generated from selling products or providing services is a fundamental component of taxable income.

Investments and Interest:

- Small businesses may earn income from investments, dividends, or interest on savings.

- This additional income, although not directly related to core business operations, contributes to the overall taxable income.

Rent and Leases:

- Rental income from properties or leasing agreements also contributes to taxable income.

- Small businesses engaging in property rental or leasing activities must account for this source of income when calculating their taxable income.

Other Business Activities:

- Miscellaneous sources, such as royalties, licensing fees, and other business-related transactions, can contribute to taxable income.

- A comprehensive understanding of all income streams is necessary to ensure accurate reporting and compliance with tax regulations.

Deducting Allowable Expenses from Gross Income to Determine Taxable Income

Operating Expenses:

- Deductible operating expenses include costs directly associated with running the business, such as rent, utilities, and employee salaries.

- Small business owners can subtract these expenses from their gross income to arrive at the taxable income.

Cost of Goods Sold (COGS):

- For businesses involved in selling goods, the cost of acquiring or producing those goods (COGS) is deductible.

- Subtracting COGS from the gross income helps determine the taxable income, providing a more accurate reflection of the business’s profitability.

Depreciation:

- Depreciation of assets used in the business, such as machinery or vehicles, can be deducted over time.

- This allows small business owners to account for the gradual wear and tear of assets, reducing the overall taxable income.

Employee Benefits and Contributions:

- Contributions to employee benefits, such as health insurance and retirement plans, are deductible.

- Considering these deductions helps small businesses provide competitive benefits while optimizing their taxable income.

Common Business Expenses that Can be Deducted

Marketing and Advertising:

- Expenses related to marketing and advertising, including online promotions and traditional advertising, are deductible.

- Small businesses can reduce their taxable income by accounting for the costs associated with promoting their products or services.

Professional Fees:

- Payments made for professional services, such as legal or accounting fees, can be deducted.

- These deductions contribute to lowering taxable income and are essential for businesses seeking external expertise.

Travel and Transportation:

- Business-related travel expenses, including transportation, accommodation, and meals, can be deducted.

- Small business owners should keep detailed records of these expenses to ensure accurate deductions and compliance with tax regulations.

Office Supplies and Equipment:

- Costs associated with office supplies, furniture, and equipment are deductible.

- Small businesses can optimize their taxable income by accounting for the necessary tools and resources required for daily operations.

Understanding taxable income for small businesses in the Philippines is pivotal for compliance with tax laws and optimizing financial outcomes. By identifying diverse sources of income, deducting allowable expenses, and recognizing common business expenses that can be deducted, business owners can navigate the complexities of taxation while ensuring accurate reporting.

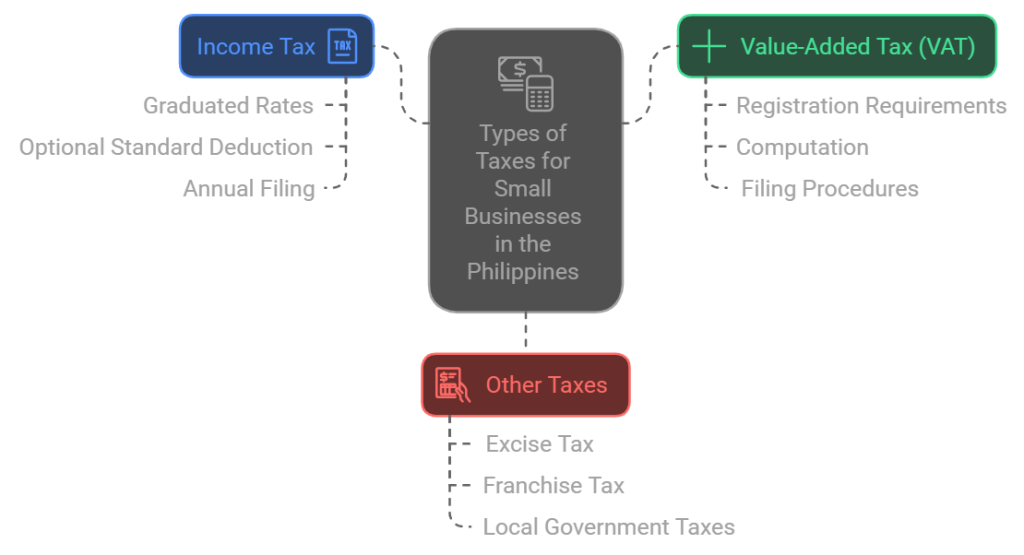

Types of taxes applicable to small businesses in the Philippines

1) Income Tax:

Small businesses in the Philippines are subject to income tax, which is imposed on their net income. The income tax rates for small businesses are progressive, ranging from 5% to 30%. Here’s an overview of the income tax rates:

Graduated Rates: Small businesses with a net taxable income of up to PHP 250,000 are taxed at a rate of 5%. The rates gradually increase as the income brackets go up.

Excess of PHP 250,000: For incomes exceeding PHP 250,000, the next PHP 250,000 is taxed at 10%, and the succeeding bracket at 15%. The rates continue to increase until reaching the maximum rate of 30%.

Optional Standard Deduction: Small businesses have the option to choose between itemized deduction or a standard deduction equivalent to 40% of their gross income. This flexibility allows businesses to select the method that minimizes their tax liability.

Annual Income Tax Filing: Small businesses are required to file their income tax returns annually, on or before April 15 of the following year. Proper documentation and accurate financial records are essential for the filing process.

2) Value-Added Tax (VAT):

Value-Added Tax (VAT) is another significant tax applicable to small businesses in the Philippines. Understanding the registration requirements, computation, and filing procedures is crucial for compliance.

VAT Registration Requirements: Small businesses with an annual gross sales or receipts exceeding PHP 3,000,000 are required to register for VAT. Once registered, businesses are obligated to charge and collect VAT on their sales of goods and services.

VAT Computation: VAT is computed based on the gross selling price or gross value of goods and services. The standard rate is 12%, but certain transactions may be subject to a 0% rate, such as export sales. Input VAT, or the VAT paid on purchases and expenses, can be credited against output VAT, reducing the overall tax liability.

VAT Filing Procedures: VAT-registered businesses are required to file VAT returns on a monthly basis using BIR Form 2550M. The deadline for filing and payment is on or before the 20th day of the following month. Timely and accurate filing is essential to avoid penalties and maintain good standing with the tax authorities.

3) Other Taxes Applicable to Small Businesses

Apart from income tax and VAT, small businesses in the Philippines may also be subject to other taxes, including excise tax, franchise tax, and local government taxes.

Excise Tax: Excise tax is imposed on specific goods, such as petroleum products, tobacco, and alcohol. Small businesses engaged in the production or sale of these items need to be aware of the applicable excise tax rates and compliance requirements.

Franchise Tax: Businesses operating under a franchise are subject to franchise tax. The tax rate is 2% of the gross receipts earned within the Philippines. Proper documentation and compliance with franchise tax regulations are essential for businesses in this category.

Local Government Taxes: Local government units (LGUs) have the authority to impose additional taxes on businesses operating within their jurisdiction. These may include local business taxes, real property taxes, and other fees. Small businesses need to be aware of and comply with the specific tax regulations set by the LGUs where they operate.

How to calculate tax for small business Philippines

How to calculate income tax on small businesses in the Philippines

Step-by-step guide on calculating income tax for small businesses

Calculating income tax for small businesses in the Philippines involves several straightforward steps. Follow this guide to determine your tax liability accurately:

Determine Gross Income:

- Start by identifying your gross income, which includes all money received by the business before any deductions.

- Consider sales, services rendered, and other operating income.

- Exclude non-operating income, such as capital gains, gifts, and inheritances.

Compute Allowable Deductions:

- Subtract allowable deductions from the gross income to arrive at the taxable income.

- Common deductions include business expenses, cost of goods sold, and depreciation.

- Be aware of specific deductions available for small businesses, such as expenses related to research and development.

Apply Income Tax Rates:

- Utilize the income tax brackets and rates provided by the Bureau of Internal Revenue (BIR).

- Determine the appropriate tax rate based on the taxable income.

- Be mindful of progressive tax rates, where higher income corresponds to higher tax percentages.

Consider Minimum Corporate Income Tax (MCIT):

- Small businesses in the Philippines are subject to the Minimum Corporate Income Tax.

- Calculate MCIT as 2% of the gross income, with certain adjustments.

- Compare the regular income tax and MCIT, and pay the higher amount.

Using income tax brackets and tax rates to determine tax liability

Understanding the income tax brackets and tax rates is crucial for accurate tax calculation. Follow these steps to navigate the Philippine tax system effectively:

Identify Tax Brackets:

- Familiarize yourself with the current tax brackets set by the BIR.

- The tax brackets categorize taxable income into different ranges, each with its corresponding tax rate.

Assign Tax Rates:

- Determine the applicable tax rate for each bracket.

- For example, the first bracket might have a lower tax rate compared to the subsequent brackets.

Calculate Tax Liability:

- Allocate the taxable income into the respective brackets.

- Apply the corresponding tax rates to each bracket.

- Sum up the calculated taxes for each bracket to obtain the total income tax liability.

Consider Graduated Tax Rates:

- Recognize that the Philippine tax system employs a graduated tax rate, ensuring that higher incomes are taxed at higher rates.

- This progressive structure aims to distribute the tax burden more equitably.

Considering special deductions and exemptions for small businesses

In addition to standard deductions, small businesses in the Philippines can benefit from special deductions and exemptions. Be aware of these opportunities to optimize your tax position:

Explore Special Deductions:

- Identify specific deductions designed for small businesses, such as the Simplified Taxation for Small Businesses (STS).

- STS allows businesses with gross sales not exceeding PHP 3 million to choose a 3% percentage tax on gross sales or opt for regular income tax rates with additional deductions.

Leverage Exemptions for Start-ups:

- Start-up businesses can enjoy income tax exemptions for the first few years of operation.

- Be informed about the specific criteria and duration of these exemptions to maximize their benefits.

Take Advantage of Tax Incentives:

- Investigate tax incentive programs that apply to certain industries or activities.

- These incentives can include reduced tax rates, tax holidays, and other advantages that contribute to lowering the overall tax liability.

Document and Verify Eligibility:

- Keep thorough records of transactions and expenses to substantiate your eligibility for special deductions and exemptions.

- Regularly review your business activities to ensure continued compliance with the requirements for these benefits.

By following this step-by-step guide, understanding income tax brackets, and exploring special deductions, small businesses in the Philippines can navigate the tax landscape effectively, ensuring compliance while optimizing their tax positions.

How to calculate Value-Added Tax (VAT) on small businesses in the Philippines

Understanding the Concept of VAT and its Application to Small Businesses

Value-added tax (VAT) is a consumption tax imposed on the sale of goods and services. In the Philippines, businesses, regardless of their size, are subject to VAT registration once their annual gross sales exceed a certain threshold. Small businesses, when registered, become VAT-registered entities and are required to charge VAT on their sales.

To calculate VAT for small businesses, one must first comprehend the concept of input and output tax. Output tax is the VAT collected on sales, while input tax is the VAT paid on purchases. The difference between these two determines the amount payable or refundable.

Determining VATable Sales and Input Tax Credits

Identifying VATable Sales:

- Review your sales transactions to determine which are subject to VAT. Generally, the sale of goods and services is VATable unless specifically exempted or classified as zero-rated.

- Examine invoices issued to customers. If your annual gross sales exceed the VAT registration threshold, which is PHP 3 million as of my last knowledge update in January 2022, you are mandated to charge VAT on your sales.

Calculating Input Tax Credits:

- Keep meticulous records of your business expenses and purchases, as these will include input tax.

- Identify the input tax amount paid on purchases by checking the invoices from suppliers. Ensure these suppliers are also VAT-registered businesses.

- Subtract the total input tax from the output tax to determine the net VAT liability or credit.

Calculating VAT Payable or Refundable

Calculating VAT Payable:

- Subtract the total input tax credits from the total output tax collected on sales. If the result is positive, this is the VAT payable to the government.

- Utilize the formula: VAT Payable = Output Tax – Input Tax.

- Ensure accuracy in your calculations to comply with regulatory requirements and avoid penalties.

Calculating VAT Refundable:

- If the input tax exceeds the output tax, you may be eligible for a VAT refund.

- The formula for calculating VAT refund is: VAT Refund = Input Tax – Output Tax.

- Prepare and submit the necessary documents to support your refund claim, such as VAT returns and supporting invoices.

Complying with VAT Filing Deadlines and Procedures

Adhering to Filing Deadlines:

- Small businesses must file their VAT returns on time to avoid penalties and ensure compliance with tax regulations.

- The VAT return filing frequency depends on the taxpayer’s annual gross sales. As of my last update, businesses with annual gross sales exceeding PHP 3 million must file monthly, while those below this threshold may file quarterly.

- Mark the filing deadlines on your calendar and set reminders to ensure timely submission.

Following VAT Filing Procedures:

- Accurately complete the BIR-prescribed VAT return form. Provide all required information, including VATable sales, output tax, input tax, and other relevant details.

- Double-check your computations to minimize errors. Inaccuracies may lead to fines or delays in processing refunds.

- Attach supporting documents, such as invoices and receipts, to substantiate the figures reported in the VAT return.

Other tax considerations for Small Businesses in the Philippines

Tax Withholding for Employees

In the Philippines, small businesses must be diligent in adhering to tax withholding regulations for their employees. This process involves deducting the appropriate taxes from employees’ salaries and remitting them to the Bureau of Internal Revenue (BIR). Failure to comply can result in penalties and legal consequences.

Proper Calculation: Small businesses need to accurately compute the correct amount of taxes to withhold based on the employee’s income. This includes income tax, social security contributions, and health insurance premiums.

Regular Remittance: Timely remittance of withheld taxes is crucial. Businesses must ensure that these deductions are remitted to the BIR on a regular schedule. Failure to remit on time may lead to penalties and interest charges.

Documentation Requirements: Keeping accurate records of tax withheld is essential. Small businesses must maintain documentation to support the amounts deducted and remitted. This documentation is subject to review during BIR audits.

Employee Education: It’s important to educate employees about tax withholding to avoid misunderstandings. Clear communication can help employees understand why certain amounts are deducted from their salaries.

Tax Payments and Filing Deadlines

Small businesses in the Philippines must adhere to specific tax payment and filing deadlines to avoid penalties and maintain compliance with tax regulations.

Quarterly Income Tax Returns: Small businesses are typically required to file quarterly income tax returns. Ensuring the accuracy of financial records is crucial to meeting these deadlines and avoiding penalties.

Value-Added Tax (VAT) Compliance: For businesses registered under VAT, compliance with monthly and quarterly VAT returns is necessary. Understanding and meeting these filing requirements is crucial for avoiding fines and maintaining good standing with the BIR.

Annual Income Tax Returns: Small businesses must file annual income tax returns. Accuracy in reporting income, expenses, and other relevant information is vital to fulfilling this obligation. Failing to file or submitting inaccurate information can result in penalties.

Penalties for Late Filing: Delays in filing tax returns can lead to substantial penalties. Small businesses should prioritize meeting deadlines to avoid unnecessary financial burdens.

Tax Penalties for Late or Non-Compliance

Small businesses need to be aware of the potential penalties for late or non-compliance with tax regulations in the Philippines.

Late Payment Penalties: Failing to remit taxes on time can result in late payment penalties. These penalties are typically a percentage of the overdue amount and can accumulate over time.

Late Filing Penalties: Missing filing deadlines for tax returns may incur late filing penalties. Small businesses should prioritize completing and submitting accurate returns within the specified timeframes to avoid such penalties.

Interest Charges: In addition to penalties, late payments may also incur interest charges. These charges accrue over time, further increasing the financial burden on small businesses.

Suspension or Closure: Persistent non-compliance may lead to more severe consequences, including suspension or closure of the business. Small businesses must prioritize meeting their tax obligations to avoid such drastic measures.

Importance of Seeking Professional Tax Advice for Complex Tax Situations

Given the complexity of tax regulations in the Philippines, small businesses facing intricate tax situations should seek professional advice to ensure compliance and mitigate risks.

Navigating Complexity: Professional tax advisors can help small businesses navigate complex tax laws and regulations. They have the expertise to interpret and apply the relevant tax codes accurately.

Customized Solutions: Every business is unique, and professional tax advisors can provide tailored solutions based on the specific needs and circumstances of a small business. This personalized approach ensures that the business remains compliant while optimizing its tax position.

Risk Mitigation: By seeking professional advice, small businesses can identify and mitigate potential tax risks. This proactive approach helps in avoiding costly penalties and legal consequences associated with non-compliance.

Audit Support: In the event of a BIR audit, having professional tax advice becomes invaluable. Tax advisors can assist in preparing for audits, ensuring that all necessary documentation is in order, and representing the business during the audit process.

Conclusion

In conclusion, small businesses in the Philippines must be vigilant in managing various tax considerations. From proper tax withholding for employees to meeting filing deadlines and understanding the consequences of non-compliance, adherence to tax regulations is crucial. Seeking professional tax advice further enhances a business’s ability to navigate complex tax situations and maintain compliance with the ever-evolving tax landscape.